What Your Self Assessment Should IncludeAccurate reporting ensures compliance and avoids penalties. Income to Include Allowable Deductions

How to pay Self Assessment tax bills (include taxcode adjustments if SA is submitted before 31 December) After filing, HMRC […]

HMRC Self Assessment Penalties (for Late Filing and Payment) HMRC applies penalties automatically if deadlines are missed. Late Filing Penalties […]

Self Assessment Deadlines (filing and payment deadlines) For the 2024/25 tax year (6 April 2024 – 5 April 2025), HMRC […]

Corporation Tax and Capital Allowances: Claiming Full Expensing & AIA For UK companies, capital allowances allow businesses to deduct capital […]

Capital Gains Tax (CGT) applies when you sell or dispose of an asset for more than you paid for it. […]

Auto-Enrolment Duties for Employers: Workplace Pension ResponsibilitiesWho must be enrolled?You must assess each worker regularly.Criteria: Qualifying Earnings:These are the earnings […]

The Autumn 2025 Budget confirmed that employees who are required to work from home will no longer be able to […]

From 1 December 2025, the Financial Services Compensation Scheme (FSCS) deposit protection limit increased to £120,000. This means savers with […]

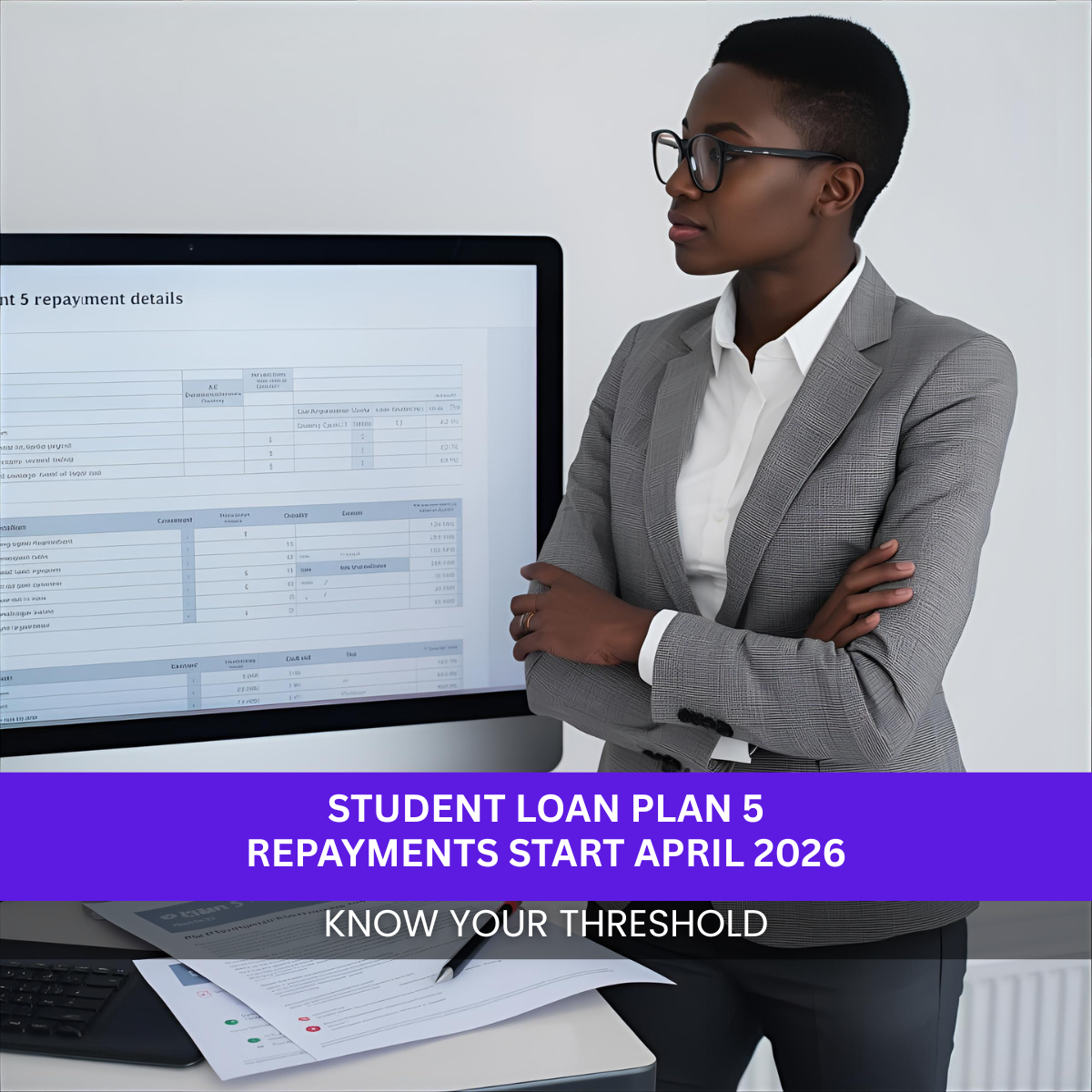

Starting 6 April 2026, a new student loan repayment plan, Plan 5, will be introduced by the Department for Education […]

When buying a rental property, you can own it personally or through a limited company. Each option affects how much […]

The penalties will double for companies submitting a Corporation Tax return late from 1st April 2026. This will be legislated […]

An ISA is a tax-efficient savings account that allows you to earn interest without paying tax on it. Currently, individuals […]

From 6 April 2027, the government will create separate tax rates for property income on Unincorporated landlords. The income tax […]

From April 2027, savers in the basic rate tax band will pay 22% in savings income tax, up from the […]

In November Autumn Budget, the Chancellor Rachel Reeves confirmed that the basic and higher rates of dividend tax will rise […]

A business may cancel VAT registration if: You must notify HMRC within 30 days of becoming eligible to deregister. What […]

The UK offers special VAT schemes to help small businesses simplify VAT reporting and improve cash flow. Standard VAT Accounting […]

Some businesses provide both taxable and exempt services. This is common in sectors like finance, education, property, and healthcare. If […]

VAT-registered businesses must keep proper records to meet HMRC requirements. You must keep: Record retention:You must keep VAT records for […]

When your business imports goods or receives services from overseas, special VAT rules apply. Imported goods Imported services Important: Keep […]

Many UK businesses supply a mix of taxable and exempt goods or services. This falls under partial exemption rules. You […]

Some supplies of goods or services are exempt from VAT, meaning you do not charge VAT on them and they […]

Understanding VAT for Small Businesses Businesses act as tax collectors for HMRC by charging VAT on their sales (output tax) […]

Corporation Tax Filing and Payment Deadlines All limited companies must file a Company Tax Return (CT600) every year. Penalties for […]

Corporation Tax Rates for UK Companies (2025/26) Corporation Tax is the main tax paid by UK limited companies on their […]

Individual Savings Accounts (ISAs) remain one of the most tax-efficient ways to save and invest in the UK. Basic ISA […]

The government is reporting that it has blocked hundreds of thousands of companies with outstanding or potentially fraudulent Bounce Back […]

If you’re self-employed, you will be taxed on the profit after claiming business expenses. HMRC allows two approaches: detailed cost […]

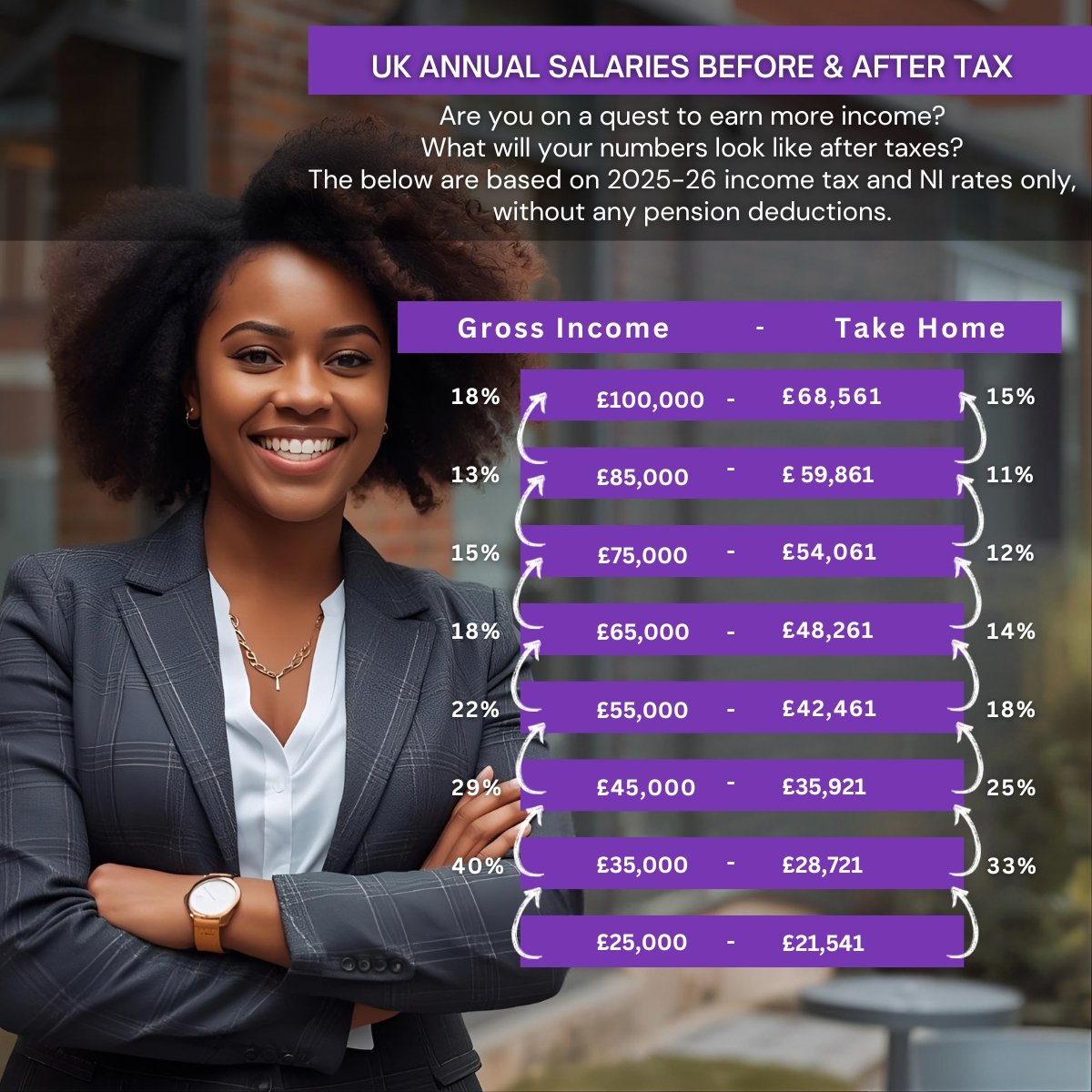

You may have noticed your take-home pay shrinking, even without a tax rate increase. This is caused by fiscal drag […]

The UK offers two special allowances that can simplify your tax return: the trading allowance and the property income allowance. […]

The UK government is rolling out Making Tax Digital (MTD) to modernise the tax system. By moving away from paper […]

Specific Self Employment Expenses: What You Can & Cannot Claim When you’re self-employed in the UK, HMRC allows you to […]

Being self-employed in the UK means you manage your own finances — including paying tax and National Insurance. Unlike employees, […]

When you save money in a UK bank, building society or credit union that’s authorised by the Financial Conduct Authority […]

Many people only glance at their net pay, but a payslip contains crucial details about how your income is taxed […]

One of the easiest tools available for saving money today is Savings Pots (sometimes called “Spaces”), offered by banks and […]

Children who learn how money works early are far more likely to grow up managing their finances well. Here’s how […]

When we talk about salaries, it’s easy to focus on the big number—but what really matters is what you take […]

Financial knowledge/literacy simply means understanding how money works in everyday life. You don’t need to be an expert, but having […]

Have you ever felt that there are no pension options when you are no longer full-time employed? Although workplace pensions […]

HMRC have released an important guidance to educate contractors on the nature of tax avoidance schemes being run by umbrella […]

Budgeting is one of the most important skills for managing money, and the good news is — it doesn’t need […]

On 7 August 2025, the Bank of England reduced the base interest rate to 4.00% from 4.25%. The aim is […]

From 18 November 2025, all company directors and people with significant control (PSCs) will be legally required to verify their […]

Limited companies can reimburse certain professional fees and membership subscriptions incurred by directors or employees, provided they meet specific HMRC […]

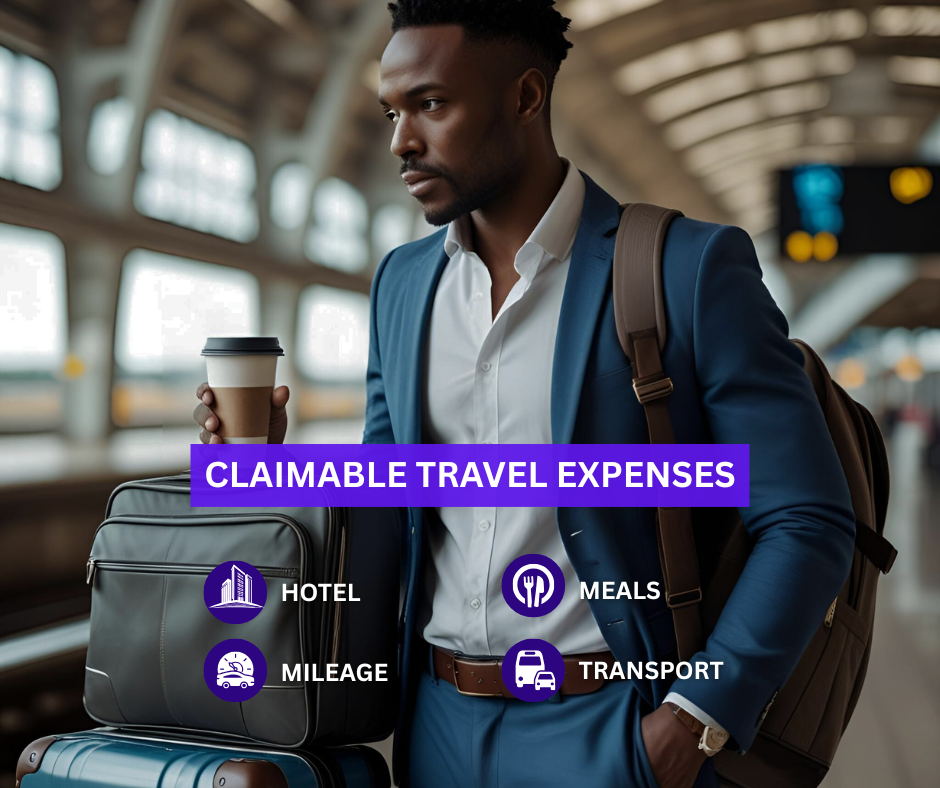

Travel costs incurred wholly, exclusively, and necessarily for business purposes may be reimbursed by a company and are typically not […]

Business-related phone costs may be reimbursed when personal devices are used for work. To avoid tax or National Insurance implications, […]

When directors or employees carry out work duties from home, limited companies can reimburse part of the household expenses incurred […]

To calculate the business expense for a director’s use of a personal vehicle for business journeys in the UK (tax […]

Most Directors think this is a once-a-year effort. Reducing tax liability is a daily thought that involves thinking about the […]

The UK Government will send a test Emergency Alert to mobile phones across the UK at around 15:00 on 7th […]

Starting a budget doesn’t have to be complicated. With just a bit of time and a few essentials, you can […]

You may have noticed a major clean-up at Companies House, as over 11,500 UK-registered companies were struck off following a […]

𝗣𝗲𝗿𝘀𝗼𝗻𝗮𝗹 𝗯𝘂𝗱𝗴𝗲𝘁𝗶𝗻𝗴 is the process of understanding, organizing, and managing your income and expenses. It’s about knowing how much money […]

If you’ve provided loans of more than £10,000 to any directors or employees, these may be considered 𝘁𝗮𝘅𝗮𝗯𝗹𝗲 𝗯𝗲𝗻𝗲𝗳𝗶𝘁𝘀. This […]

Beginning January 2026, Reporting Cryptoasset Service Providers (RCASPs) will be required to collect your user and transaction data and report […]

Under the Economic Crime and Corporate Transparency Act (ECCTA), changes are coming to the way small and micro companies file […]

Employers will need to note the new government timeline for mandating the reporting and payment of Income Tax and Class […]

HMRC is reporting that more than 100,000 PAYE clients have been impacted by unauthorized access and filings on their online […]

As part of the Government’s Plan to Make Work Pay, changes to Statutory Sick Pay (SSP) are on the way […]