The UK offers two special allowances that can simplify your tax return: the trading allowance and the property income allowance. […]

The UK government is rolling out Making Tax Digital (MTD) to modernise the tax system. By moving away from paper […]

Specific Self Employment Expenses: What You Can & Cannot Claim When you’re self-employed in the UK, HMRC allows you to […]

Being self-employed in the UK means you manage your own finances — including paying tax and National Insurance. Unlike employees, […]

The other most important question is, “if I do not tell HMRC about these hustles, will anyone tell them?”. On […]

When you save money in a UK bank, building society or credit union that’s authorised by the Financial Conduct Authority […]

Many people only glance at their net pay, but a payslip contains crucial details about how your income is taxed […]

One of the easiest tools available for saving money today is Savings Pots (sometimes called “Spaces”), offered by banks and […]

Children who learn how money works early are far more likely to grow up managing their finances well. Here’s how […]

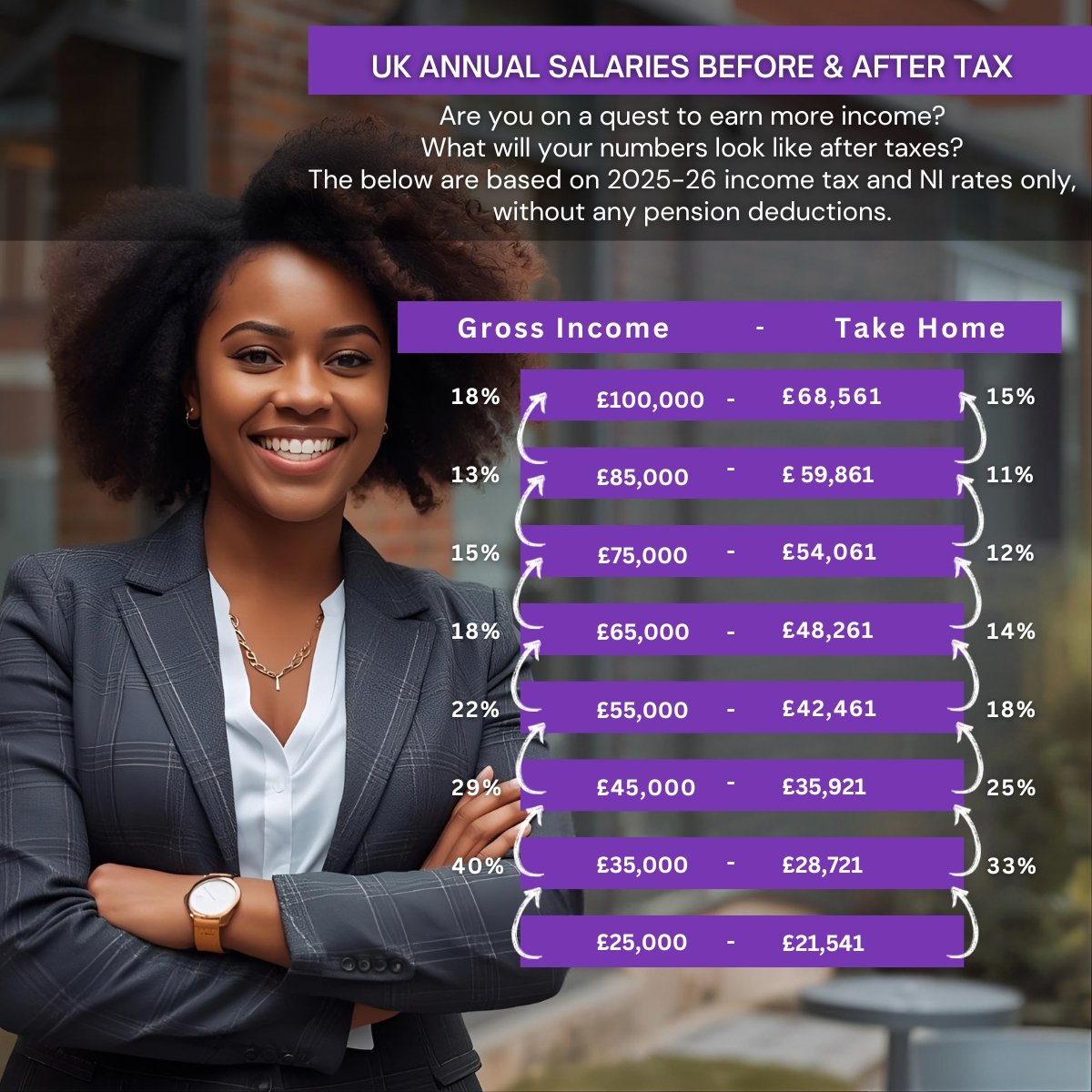

When we talk about salaries, it’s easy to focus on the big number—but what really matters is what you take […]